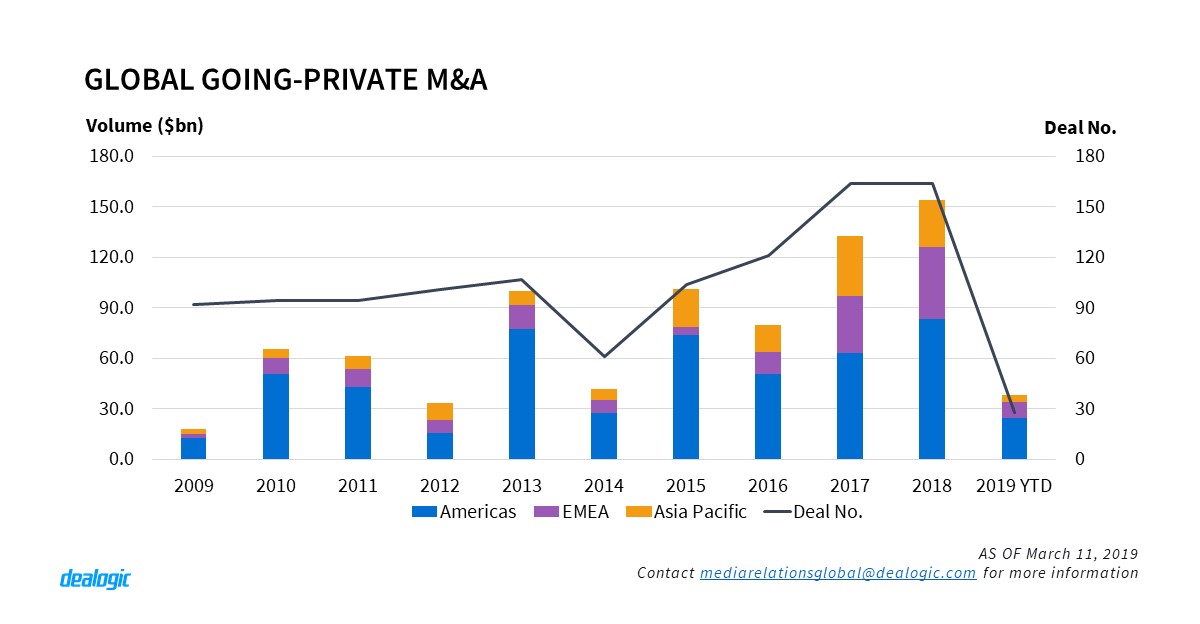

In 2018, global going-private M&A reached a record $154.3bn in volume with 164 deals. The Americas region was the biggest contributor to the record, with deal volume of $83.6bn. The Americas had a 32.9% increase in deal volume year over year ($62.9bn in 2017), followed by a 25.3% increase in the EMEA region ($34.0bn in 2017 and $42.6bn in 2018). Asia Pacific was the only region that posted a decline with a 21.0% decrease in volume ($35.6bn in 2017 and $28.1bn in 2018).

2019 going-private YTD volume has gotten off to a strong start with $38.2bn in volume with 28 deals. A 30.9% increase from 2018 YTD volume of $29.2bn with 38 deals. 2019 YTD volume is now 29.4% of the total volume from last year. At the current pace of 2019 volume we expect a continued upward trend for a new record high in going-private M&A volume by the end of the year.

Technology continues upward momentum

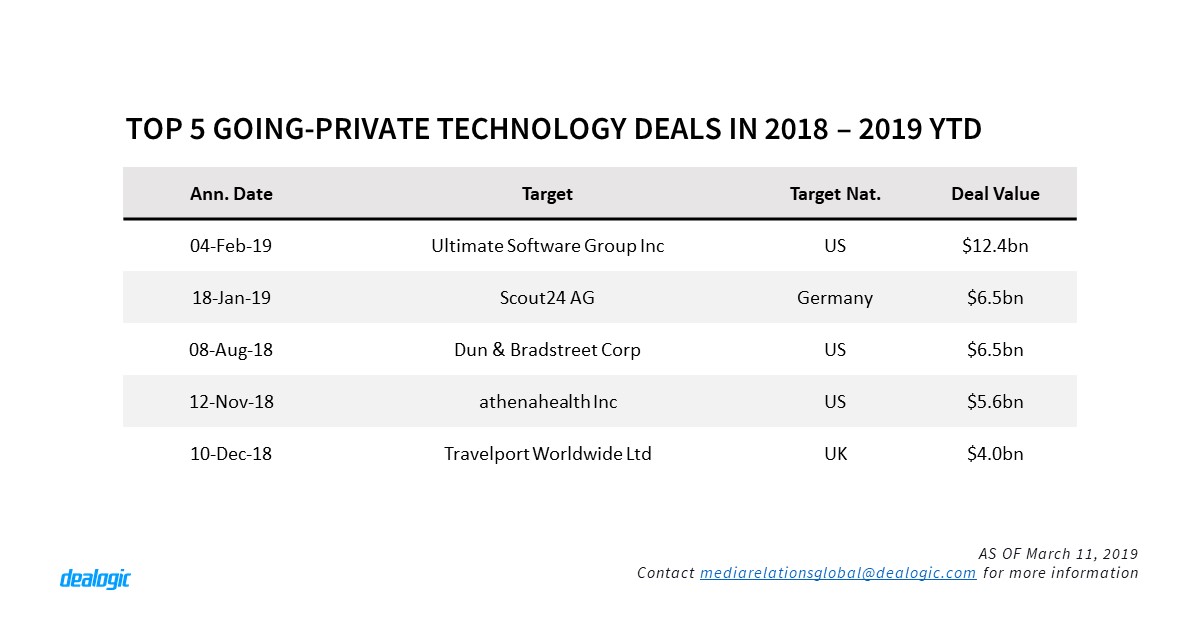

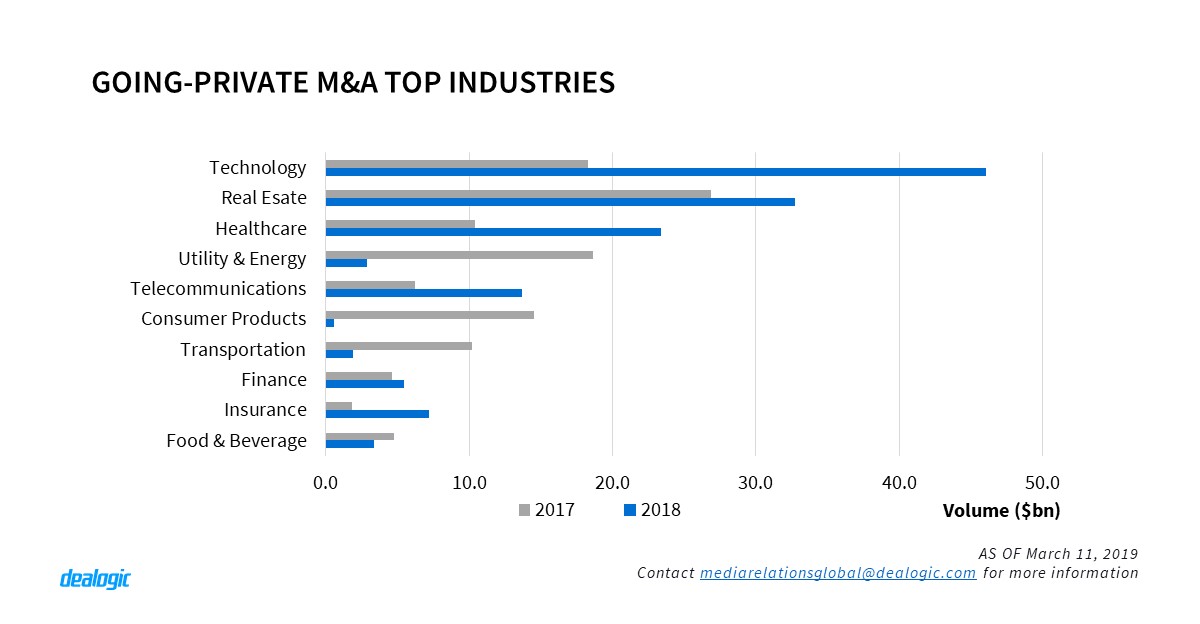

The technology sector led global going-private M&A volume in 2018 with $46.1bn, posting a 151.9% increase in volume from 2017 ($18.3.bn). Technology continues to be the top sector in 2019 due to deals of Ultimate Software Group Inc ($12.4bn) and Scout24 ($6.5bn), the largest deals including all of 2018. We expect technology deals to continue being the leading sector in 2019 especially within software. Due to well-established software companies having stable revenue streams and consistent profitability.

– Written by Lawrence Santoruvo

Data source: Dealogic, as of March 11, 2019

Contact us for the underlying data, or learn more about the powerful Dealogic platform.