China IPO Languished

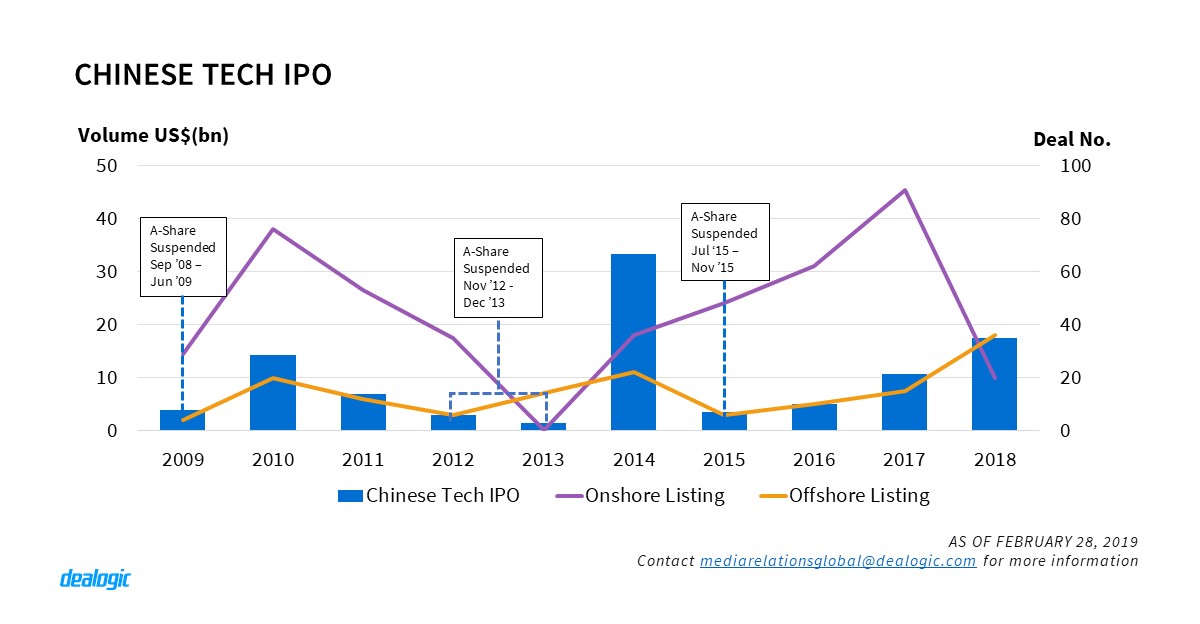

After the Chinese government imposed a stricter IPO approval process last year, the number of Chinese A-share IPOs plunged 76.6% compared with 2017, resulting in a 52.2% drop in the overall Chinese onshore ECM volume. Amidst the downturn in the domestic market, 117 Chinese companies applied to list offshore, marking the highest level in deal activity since 2010 (126 listings).

Rise of Chinese Tech Companies

Technology sector was the leading sector for Chinese companies in pursuing an offshore listing last year – in fact, 36 out of 117 companies pursued an offshore listing last year was from the sector. Since the $25.0bn listing of Alibaba Group in 2014, there has been a steady increase in the tech offshore volume from Chinese businesses. The offshore tech listing volume jumped by approx. 35.5 times in the 4-year period between 2015 and 2018. Amongst the top 20 Chinese tech IPOs in the past 4 years, only 5 companies listed onshore, with the rest listed in Hong Kong and the US. 2018 also saw a record high of 36 tech offshore IPOs, outpacing the onshore activity for the first time since 2013, where the application was suspended.

Upcoming Shanghai Science and Technology Innovation Board

To incentivize the tech companies and start-ups to pursue a listing onshore, the China Securities Regulatory Commission (CSRC) has recently started a public consultation on a new board named Science and Technology Innovation Board in Shanghai. The consultation period was recently closed last week and the board could be ready to kick off as early as June.

Under the CSRC’s new proposals, it has suggested rules to allow 1) weighted voting rights structure (WVR) companies, 2) pre-profit companies and 3) red chip companies, to list on the new board, where some of these features are currently available in Hong Kong and US but not in China. In the past decade, 145 Chinese tech companies listed offshore, and 50 of them listed with the WVR structure including JD.com ($2.0bn) and Meituan Dianping ($4.2bn). The new board may provide an alternate listing location for Chinese tech companies, which is likely to stimulate onshore listing in the second half of the year.

– Written by Vincent Li & Calvin Li

Data source: Dealogic, as of February 28, 2019