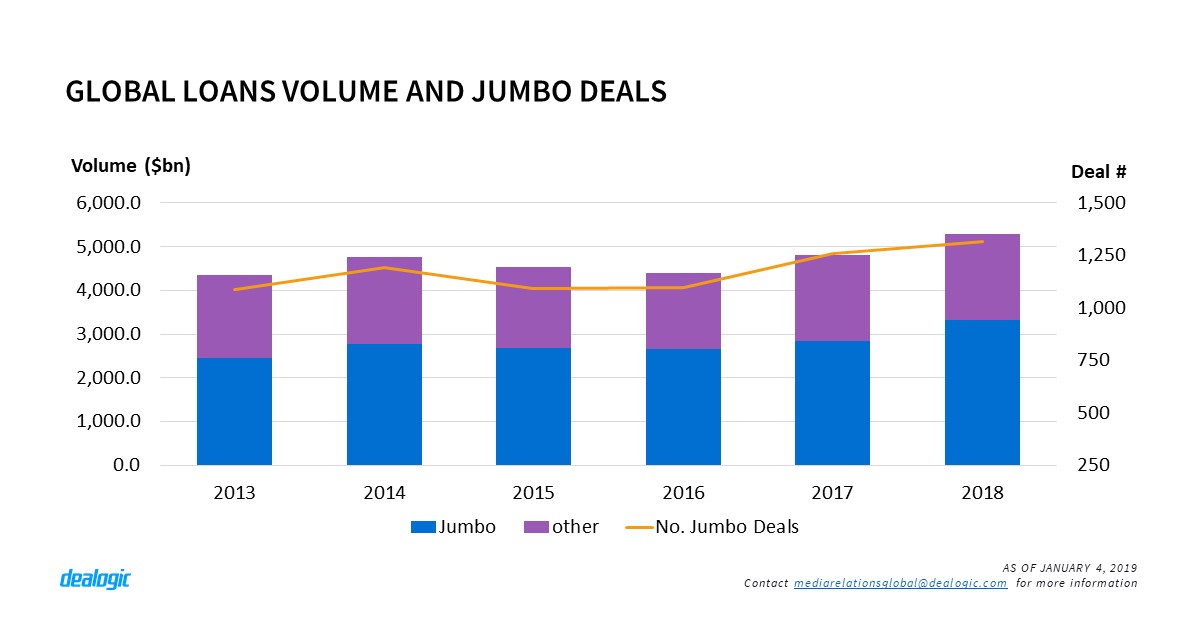

Global Landscape – Jumbo* deals on the rise

Global syndicated loans volume reached $5.28tr in 2018, up by 10% from 2017 despite a fall in activity from 10,180 to 9,733 deals. 2018 volume has been cushioned by jumbo deals which saw a marginal year-on-year rise in activity by 58 deals, yet volume jumped more significantly by 17%. Whilst refinancings accounted for 57.9% of all jumbo facilities, jumbo M&A-related deals witnessed a sizeable increase from $620.1bn last year to $874.3bn in 2018. In fact, the top 5 largest loans in 2018, which include Disney $37.5bn and Takeda $30.9bn, were all for acquisition purposes.

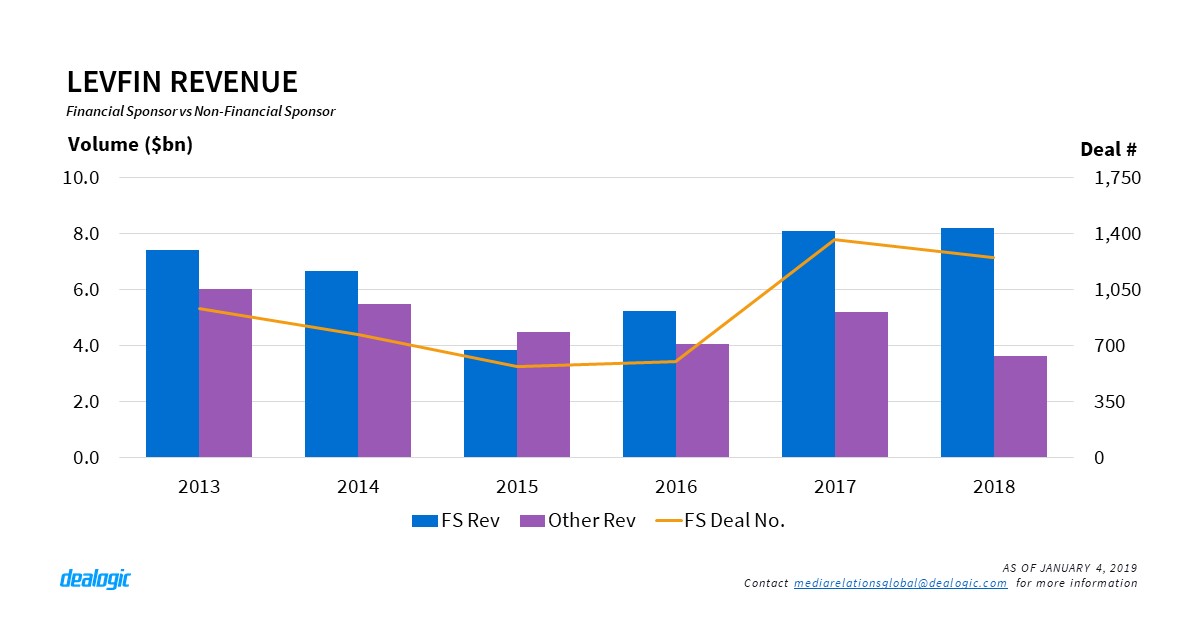

LevFin – Financial Sponsors bankroll Bankers

Financial sponsor-backed facilities accounted for 69.3% of LevFin – institutional loans & HY – revenue in 2018, up by 8.4 points year-on-year. New institutional LBO volume in both the US and Europe increased by 40%, leading to a healthy jump in wallet by $1.4bn year-on-year. 2018 saw the institutional leveraged loans wallet in the US reach $8.2bn, a new record level amidst a fading HY market. HY in 2018 was marred by rising cov-lite structures accounting for more than 80% of US institutional loans volume, rising yields which put off issuers from tapping the DCM market, and a sharp reduction of non-financial sponsor facilities, down by 42% year-on-year. Likewise, European bankers enjoyed a record year from a LevFin wallet perspective with $2.6bn paid.

As bankers enjoyed a record payout, regulators and politicians are raising concerns on the level of indebtedness and investor protection. The volume of new jumbo LBOs for instance increased by 15% year-on-year. Similarly, subordinated loans in the US saw volume climbing from $30.4bn to $31.5bn and activity rise from 162 to 187 deals.

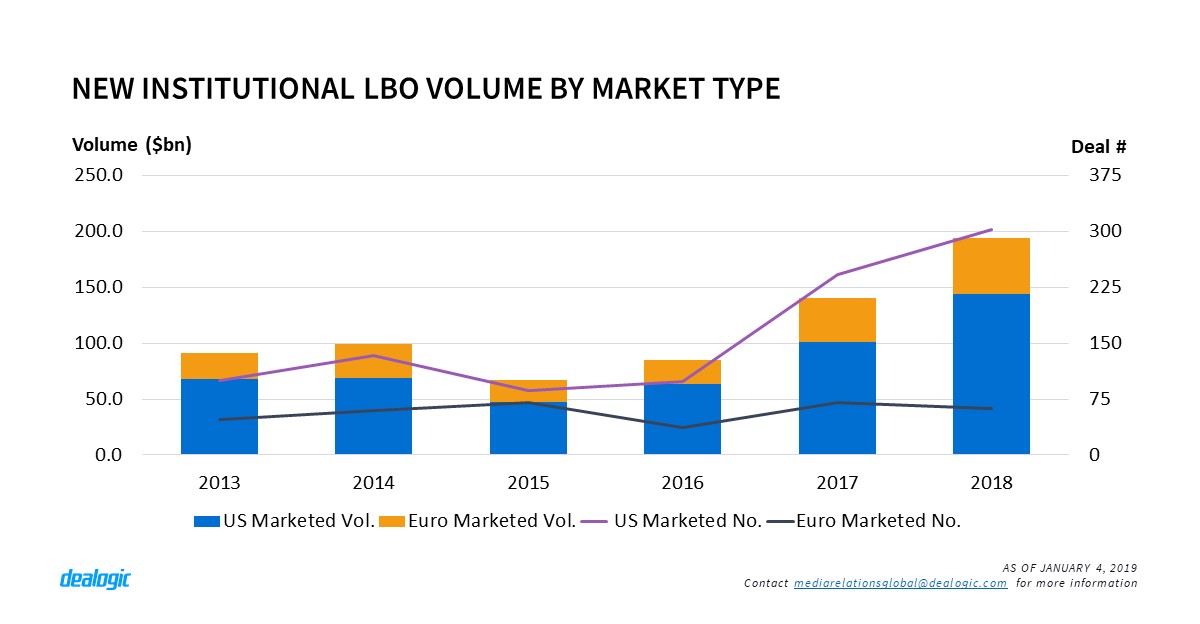

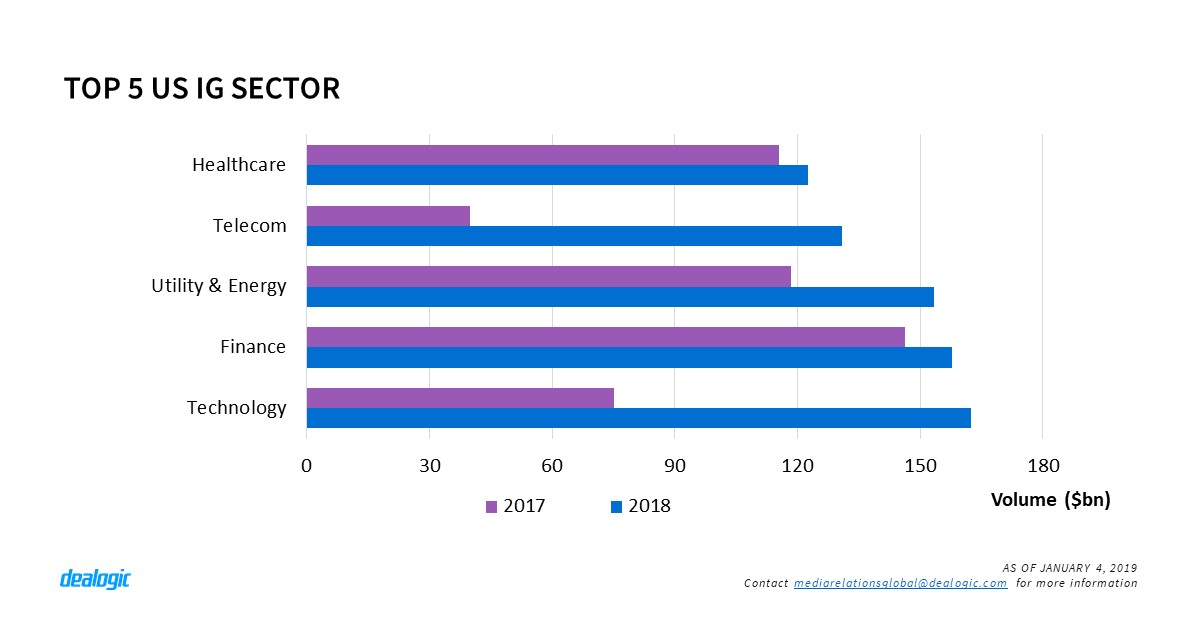

US Marketed Volumes hits new record

US-marketed loans volume totaled a record $2.92tr in 2018. The market was driven by investment grade borrowers which increased both volume and activity by 37% and 15%, respectively. Leveraged loans which dominated issuance in 2017, saw a reduction in volume and activity from $1.66tr via 3,227 deals in 2017 to $1.49tr via 2,966 deals in 2018, this is mainly due to a reduction in refinancing levels after a record 2017 year. The investment grade market growth can be attributed to the huge growth in acquisition-related loans which increased by 63% year on year with an average deal size of $3.3bn, up from $3.1bn in 2017. Technology saw a huge jump from $75.2bn in 2017 to $162.5bn in 2018 driven by M&A-related facilities and refinancings which increased by 2.7x and 1.2x, respectively on 2017.

EMEA’s Debt wall as Brexit Looms

2018 saw EMEA-marketed deals hitting its highest volume ($1.28tr) since 2015 ($1.36tr). Activity year-on-year also increased from 2,095 in 2017 to 2,098 deals in 2018. From a regional perspective, Europe, Middle East and Africa all saw increases in volume of 15%, 93% and 50%, respectively on 2017. New M&A-related financings in 2018, which increased by 30% from 2017, have definitely helped to sway volume to record levels. With Brexit looming in 2019, EMEA has $4.04tr of debt outstanding. Non-British borrowers currently hold $18.3bn of Sterling-denominated debt whilst British borrowers’ outstanding debt denominated in Euros amounts to $87.8bn.

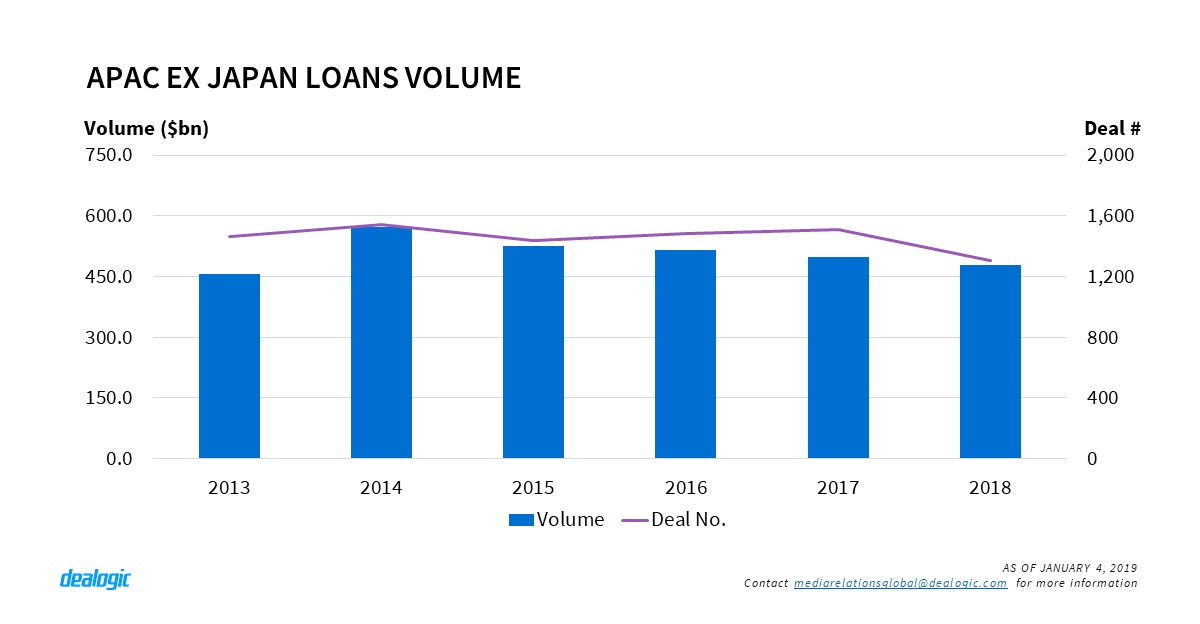

APAC (ex-Japan) volume continuous fall

Since 2014, where it recorded $572.9bn via 1,542 deals, APAC (ex-Japan), volume has been falling year on year to reach $478.7bn in 2018, a 4% fall from 2017 and the lowest activity during the last 5 years. A lackluster project finance market has inevitably contributed to the fall in volume. Furthermore, increasing refinancing and debt repayment, which jumped from $154.0bn in 2017 to $186.3bn in 2018, highlights the lack of new deals coming to the market. In addition, M&A-related loans volume was quite timid in 2018 with $30.1bn via 65 deals.

*Jumbo deals – loans that are equal or greater than $1bn

– Written by Dealogic Loans Research

Data source: Dealogic, as of January 4, 2019

Contact us for the underlying data, or learn more about the powerful Dealogic platform.