A number of new players have entered the block trades market in recent years

New players on the block

US block trades have been traditionally dominated by the top seven banks in the field (with a total of 82.9% market share since 2008). Meet the block trade players who are shaking up the market:

- Wells Fargo has the best record. In 2016, they ranked eighth ($3.0bn via 23 deals) in the US block trades league table. So far this year, the bank has already moved up to seventh place ($1.3bn via eight deals)

- RBC ranked 11th place last year with $893m, up more than 300% compared to 2015 ($266m via 3 deals)

- Jefferies this year was a sole-bookrunner for Kite Pharma’s $410m block trade. This single deal is already half of the total block volume Jefferies did in 2016 ($806m via 8 deals)

- R.W. Baird has already bookrun four deals totaling $508m, already surpassing their highest yearly volume on record

- Cantor Fitzgerald were virtually non-existent in the block market until last year, when they hired waves of veterans from big banks and set up their own block trade business. This year Cantor has underwritten four deals worth $316m, already surpassing full-year 2016 ($149m via 3 deals)

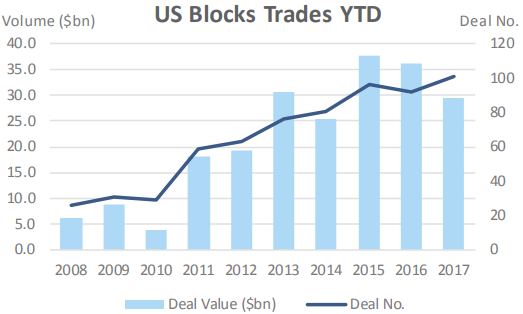

US blocks total $28.9bn via 101 deals this year, declining from the record high set last year ($84.9bn via 210 deals). However, deal activity has reached the highest in a decade. These new players are still relatively small compared to the top seven banks, and a larger block trade market will present further opportunities for them to grow.

Financial sponsors back up more block trades

A majority of the increase for US block trades in recent years came from sponsor-backed deals. Between 2012 and 2017 YTD, sponsor-backed deals accounted for an average 52.8% of block volume compared to 26.0% between 2006 and 2011. Looking at all US block trades between 2012 and 2017 YTD, Blackstone ($24.3bn via 69 deals), Carlyle Group ($17.0bn via 60 deals),and Bain Capital ($16.8bn via 54 deals) were the top three financial sponsors.

Contact us for underlying data of blocks and the US ECM market, or learn more about the Dealogic platform.

Data source: Dealogic, as of June 20, 2017